HodlBot is a self managed crypto index fund. Essentially it maintains a portfolio for you that tracks the top performing crypto projects based on your requirements.

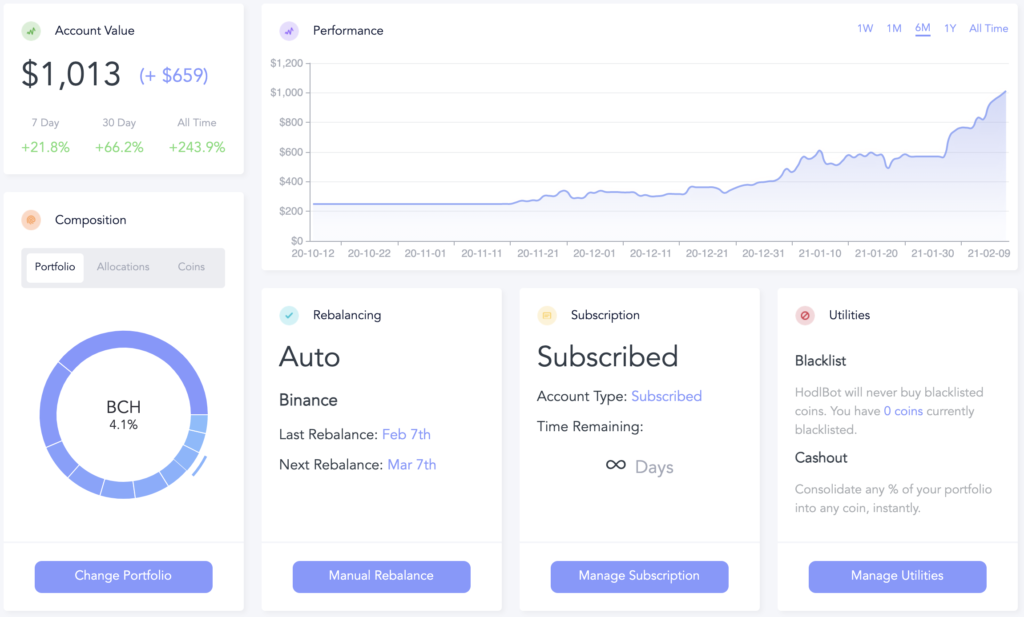

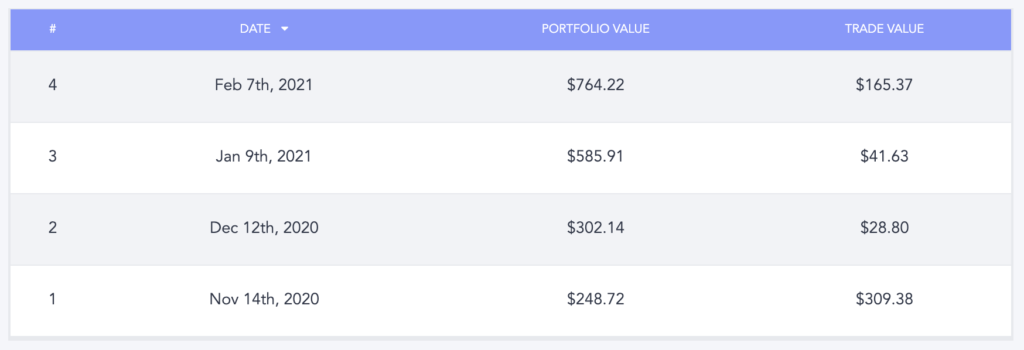

In November 2020 I deposited $250 into a crypto exchange and configured HodlBot to manage it using a HODL 10 Index strategy and in the 4 months since the portfolio has grown to a value of $1,013.11.

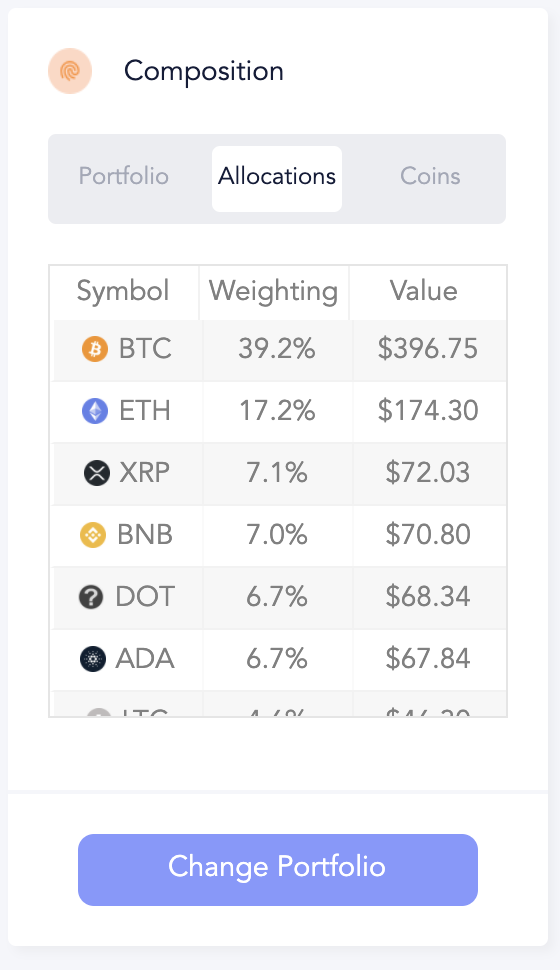

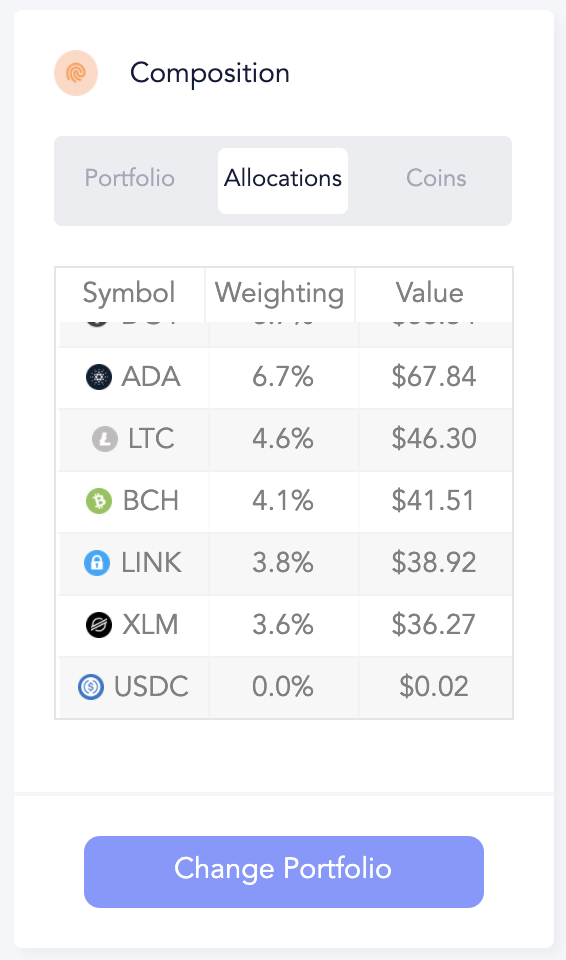

HodlBot supports 4 different index strategies HODL 10/20/30 where it rebalances your portfolio to the top 10/20/30 crypto projects as well as the Coinbase Index where it rebalances solely across the top projects available on Coinbase.

You can also create your own rebalancing strategy, blacklist specific projects you do not want to be a part of and define how often you want your portfolio to be rebalanced. I’ve left it at the default setting of once a month.

Each month HodlBot will rebalance my portfolio to the 10 top performing projects across the top of the market. As a comparison

| Project | Price 2020/11/14 | Price 2021/02/12 | Growth |

| Bitcoin | $16,326.81 | $47,645.28 | 292% |

| Ethereum | $475.97 | $1,780.55 | 374% |

| HodlBot | $250.00 | $1,013.11 | 405% |

Looking at the above chart, HodlBot has outperformed simply holding either Ethereum or Bitcoin. We are in a bull market and everything is trending up and this is one of many strategies available. I’m curious to see how the portfolio behaves if it’s left during a bear market.